The Uncertain Future of the Local Real Estate Market

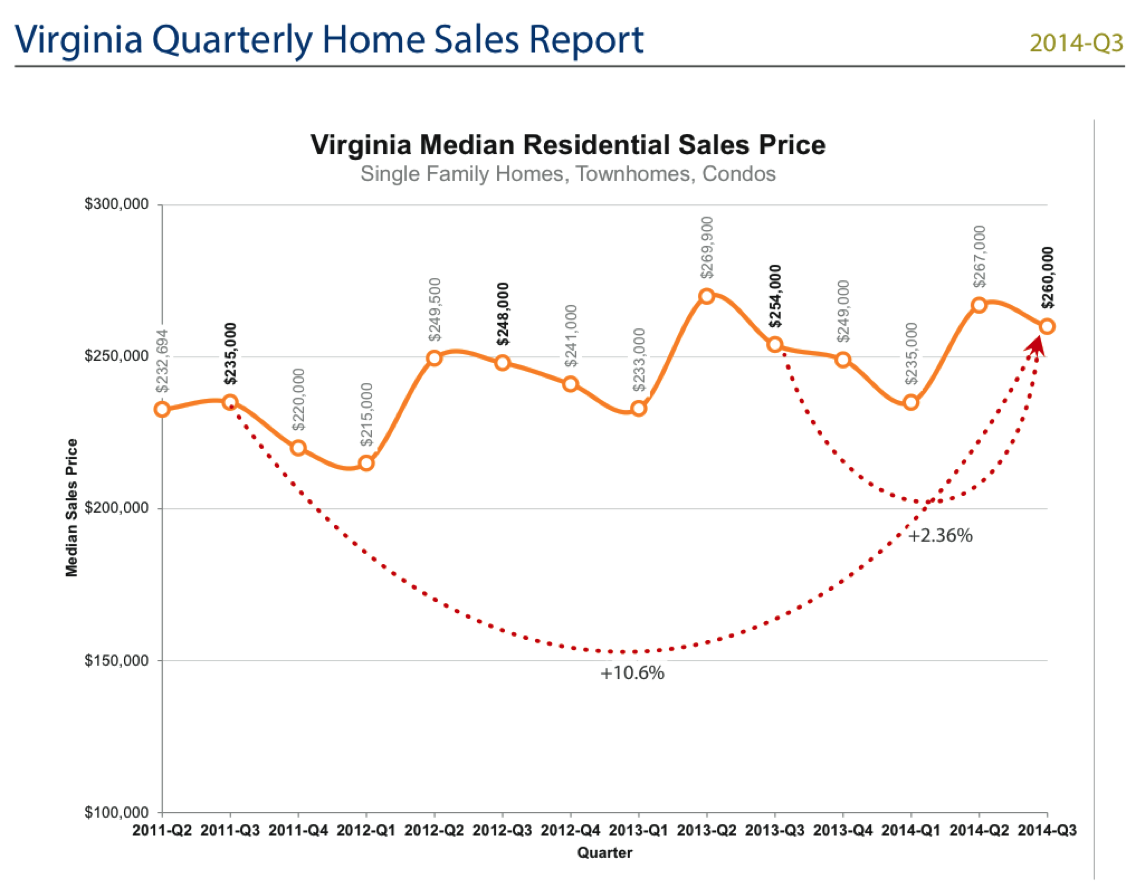

By Kuangdi Zhao and Victoria Coates Real estate sales, both nationally and locally, have experienced a steady increase since 2011, with 2014 on track to be the most successful year yet.

“We’ve gotten more steady in our sales,” said local real estate agent Scott Baker of JF Brown Real Estate, with the average price of a home sold being $225,000 this year.

Source: The Virginia Association of REALTORS

Source: S&P Dow Jones Indices LLC.

The S&P Case-Schiller Composite 20 index has recovered slowly since 2009, suggesting that the average performance of twenty major U.S. cities is gently improving.

However, it is possible the upward climb may not be tenable.

While sales have increased, local real estate broker Janie Harris remains cautious in her outlook on the market. “Even though it is an improved market, it is one that still leaves everyone a little anxious,” she said.

A major cause for local uncertainty is the new on-campus living requirement for Washington & Lee students in their third year, who make up a huge portion of lessees in Rockbridge county. This change will affect not only rental property, but home sales as well.

Scott Hoover, a professor at the Williams School, expects this new policy to have a major affect on the local real estate market. Starting in 2016, around 425 fewer students per year will require rented housing. This will cause a 50-53% drop in local rental demand. This, in theory, will cause the sale prices of local real estate to drop, while also lowering rental prices.

Hoover suggested that the drop in rental price will have a ripple effect on the values of all houses in town. Once there are not enough lessees to fill all the houses, some houses that are currently filled with students will become empty. Landlords of the empty houses will then consider selling their houses, rather than having the homes sit empty without any return. This could cause an increase in the amount of “For Sale” signs popping up around town.

Hoover also noted that the performance of the local real estate market depends on the performance of the local economy. The performance of the real estate market can be viewed as a key barometer of the economy. If the economy is strong, the real estate market will perform well, regardless of hikes in interest rates.

Despite the fact that the rise of interest rates costs more money for homebuyers, a stronger economy creates higher demand for houses, which subsequently boosts the real estate market. Without the presence of large corporations, the Lexington economy primarily relies on higher education and tourism. Rockbridge County has a median household income of $45,859, below the national median household income of $51,939, according to the U.S. Census Bureau.

Hoover stated that the buyers of local houses are chiefly retirees and college professors― not a huge number when added together. Weak demand, combined with the impact of W&L’s third-year housing program, could eventually result in a drop in housing prices. “The thing we don’t know,” Hoover added, “is how far.”

Recent transactions suggest that the local real estate market seems to have performed in a stable manner since 2008. Nonetheless, Hoover noted that only a few transactions of real estate have been made since the downturn. Conclusions drawn from insufficient data can be inaccurate, thus it is unclear how the local real estate market is performing compared to the S&P Case-Schiller Composite 20 index.

The end of the third quantitative easing adds more uncertainty to the future of the local real estate market, alongside the national market. The Federal Reserve ended QE3 on Oct 29th 2014, putting an end to the Zero Interest Rate policy. Conventional wisdom suggests that the end of QE3 will result in a rise in interest rates and negatively affect the real estate market. However, it is still uncertain whether the interest rate is going to rise or not. According to the World Bank, in 2012, the U.S. had an average lending interest rate of 3.3%. Bankrate.com states that the Virginia mortgage rate ranged from 2.98% to 3.54% in the past 12 months.